Complete Guidelines for NGO Registration in India

A non-governmental organization (NGO) is an association that is formed, managed, and worked for the benefit of the lower segments of society. These are not non-profit organizations that have goals and objectives concerning non-profit making organizations.

The integration of an NGO Registration in India is not an easy task. Apart from the money, a lot of hard work, determination, and a real desire to help others are needed to start an NGO. NGOs unlike the Company are constituted for the welfare of society without waiting for profits.

Are you ready to start an NGO in India? If so, we will go further on how to proceed.

Guidelines NGO Registration India as a Trust

One of how an NGO can be registered is confidence or more commonly known charitable trust. The trust is a legal entity created by the "Trust" or "settlor," which transfers the assets to the second party or "Trustee" for the benefit of third parties or "beneficiary."

For the trust registration, the following documents are required:

- An electricity bill or water indicating the address to be recorded.

- Proof of identity of at least two members of the society.

The proof can be:

- Voter ID

- Driver's license

- Passport

- Aadhar card

Guidelines NGO Registration India as a Society

A corporation is an entity that can be created by a group of individuals united in their cause for the promotion of science, arts, literature, social welfare, and useful information. The Companies Act registration, 1860 govern companies. They must be registered with the respective state company register to be eligible for the tax exemption.

For registration of the Company, the following are essential:

- The name of the Company.

- Address proof of the office.

Proof of identity of all new members who may be:

- Driver's license

- Copy of passport

- Voter ID

- Aadhaar card

Guidelines NGO Registration India as Section 8 Companies

A section 8 company is similar to trust and society. The goals of section 8 Companies are to promote the arts, science, commerce, sports, social welfare, religion and charity, and environmental protection. NGO registration is under the Act, 2013 in charitable societies. They have greater credibility with government agencies, donors, and other stakeholders.

For Section 8 registration of companies, the following are essential:

- The name of the Company for approval.

- Address proof of the office. It can be an electric bill or water or a tax receipt from home.

Proof of identity of all directors who may be:

- Driver's license

- Copy of passport

- Voter ID

- Aadhaar card

Note: It takes about 8 to 10 days for writing. After that, it takes about 2 months for the whole Company registration to be completed.

View Source: http://filingbazaar1.mystrikingly.com/blog/complete-guidelines-for-ngo-registration-in-india

Tax Process for Sole Proprietorship Businesses in India

Filing Bazaar is the best form of business done in India because any specific law governs it. It is the market leader in business registration services in India, offering a variety of company registration as the registration of private limited liability company, a record company person, Producer Company Registration and registration of the Indian subsidiary.

What is a Sole Proprietorship?

A sole proprietorship is a business form individually owned by a person. It is also known as a single operator or just an individual. This kind of business entity in which he is the only one owner who starts a business with a goal of profit, regarding the sole owner of responsibility has unlimited liability which means that it has to pay the debts and losses of the company.

There is no minimum investment requirement capital, and the owner has full control and participation of the property.

Features of Sole Proprietorship

- Single owner

- Limited capital

- Unlimited liability

- The only bearer of profit and loss

In this article, we examine the process of forming a sole proprietorship in India.

Sole Proprietorship License

As explained above, the existence of a sole proprietorship is established by licenses or registrations or certificates on behalf of the property owner. Based on the type of business, the following are some of the easy Proprietorship Firm Registration for establishing a sole proprietorship in India.

Requirements of the sole proprietorship

Pan card- Owner of Permanent Account Number is required. Therefore, the first step towards a single owner to acquire a PAN card of government authority is the documents listed below:

Aadhar Card: Aadhar number is now a necessity to apply for registration in India. Statement of income tax cannot be filed if the person has linked his PAN card with the Aadhar number. Contact the nearest E-Seva Mitra or Aadhar Kendra if you do not have an Aadhar number. After asking the Aadhar card, a hard copy of the same received at the registered address in 15-20 days.

Registered office proof:

- If it is a rented property: the lease and the NOC of an owner.

- If it is a self-ownership: utility bill or other proof of address.

GST Registration:

- PAN card, photo and owner of Aadhar card

- Proof of place of business (electricity bill/lease)

- Copy of the Bank's statement (first page to verify the bank account number, address and code IFSC)

View Source: https://filingbazaar1.wordpress.com/2019/10/09/tax-process-for-sole-proprietorship-businesses-in-india/

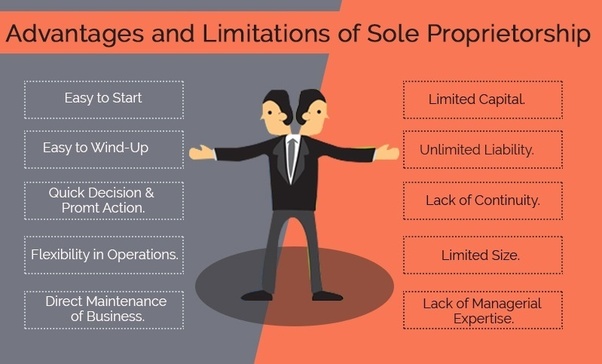

What are the Advantages and Disadvantages of Sole Proprietorships?

Sole proprietorship is that form of business organisation; which is owned and operated, at the initiative and risk of only one individual-called the sole proprietor. The sole proprietorship is an informal type of business owned by one person.

Here Filing Bazaar team guides you to build your Sole Proprietorship and proprietorship firm registration

Features of Sole-Proprietorship:

Following are the salient features of the sole-proprietorship, as a form of business organisation:

- There is individual ownership, in sole-proprietorship. One man alone-called the sole- proprietor is the owner of all assets and resources of business.

- The sole proprietor is solely responsible for the management of his business enterprise. The sole proprietor may engage the services of professional managers; yet it is he who is responsible for regulating the decisions and actions of hired managers.

- The sole proprietor is solely responsible for arranging finances for his business. He has to contribute capital from his own sources. He may also borrow money from friends, relatives and others-at his personal risk. Because of limited financial capacity of one individual (in majority of cases, of course), the size of one-man business is usually limited.

- In one man business (i.e. sole proprietorship), there is independent decision-making by the sole proprietor. He need not consult with others; while taking decisions for his own business.

- The liability of sole proprietor is unlimited, i.e. his personal properties may be utilized for payment of business debts; in case assets of business are insufficient to pay business liabilities, in full.

Advantages of Sole-Proprietorship:

Following are the main advantages of the sole proprietorship:

- Easy to Start:

Sole-proprietorship is easy to start. What is required to start the business is just a decision of the sole-proprietor in this regard. No legal and procedural formalities are required to be complied with for starting the sole-proprietary business.

- Maximum Incentive to Work:

In sole proprietorship, there is maximum incentive to work for the sole-proprietor.

Such incentive is usually due to the following factors:

- Liability of the sole proprietor is unlimited.

- There is no sharing of profits with anyone.

- Independent Decision-Making, Facilitating Flexibility of Operations:

In sole proprietorship, there is independent decision-making, by the sole proprietor. He is under no obligation to consult with anyone while taking decisions pertaining to his own business.

As such, sole proprietorship has the advantage of flexibility of business operations i.e. according to circumstances; the sole proprietor can effect changes in the operational life of business – to take maximum advantage of favourable business opportunities.

- Maintenance of the Secrecy of Business Affairs Possible:

Sole proprietorship is the exclusive form of business organisation, in which complete secrecy of business affairs is possible. The sole proprietor need not disclose his business secrets to anyone- howsoever close to him. Capitalizing on his position, he may make soaring profits-keeping business secrets absolutely confidential.

- Personal Attention to Customers:

The sole proprietor can pay personal attention to his customers; and develop good customer relations. That is why, for businesses where personal attention to customers is necessary; sole proprietary form of business organisation is most suitable e.g. tailoring business, hair-cutting saloons etc.

- Freedom from Governmental Control:

A sole-proprietary business is practically free from Governmental control and regulations. There is nothing like a ‘Sole Proprietary Business Act’, in our country.

- Self-Employment:

Starting a sole-proprietary business immediately generates “self- employment” for the sole proprietor. This is a social advantage of sole proprietorship.

The disadvantages of Sole Proprietorships:

- Owners are fully liable. If business debts become overwhelming, the individual owner’s finances will be impacted. When a sole proprietorship fails to pay its debts, the owner’s home, savings, and other individual assets can be taken to satisfy those debts.

- Self-employment taxes apply to sole proprietorships. Owners must pay self-employment taxes on the business income.

- Business continuity ends with the death or departure of the owner. Because the owner and the sole proprietorship are one, if the owner dies or becomes incapacitated then the business dies with them and the money and assets of the business become part of the individual's estate. The assets and money are subjected to inheritance taxes and can have a great impact on employees of the sole proprietorship.

- Raising capital is difficult. Initial funds of the business are generated by the owner and raising funds for the business can be hard since they cannot issue stocks or other investment income. Loans may also be difficult if the owner does not have enough credit to secure additional money.

Here India’s largest corporate legal services provider team of Filing Bazaar professional lawyers will guide you and help in proprietorship firm registration.

View Source: http://filingbazaar1.strikingly.com/blog/advantages-disadvantages-of-sole-proprietorship

All about GST Audit Checklist, Rules & Applicability

Goods and Service Tax (GST) are structured for efficient tax collection, reduction in corruption, easy inter-state movement of goods and a lot more. The GST Law provides for self-assessment to facilitate easy compliance and payment of taxes. It also explains the notices, the demand and recovery provisions when the taxes are unpaid, short paid and/or returns are not filed.

Here team of Filing Bazaar helps you in GST Filing, GST Auditing, and GST Registration in all around and especially in Gurgaon.

According to the GST law, the assessed is required to self-assess his GST returns filed during any financial year. Thus, he must determine the tax liability without any intervention by the tax official. Other than this, the tax authorities may undertake to make GST audit at any point of time or period as per the existing law.

According to CGST Section 65(3), The GST registered person will get a notice in advance not less than fifteen working days prior to the conduct of GST audit. The notice will be in FORM GST ADT-01.

So here team of filing helps in all corporate legal services specially GST Filing, GST Auditing, and GST Registration in Gurgaon within minimum time at affordable price.

Meaning of GST Audit

The meaning of GST Audit is the records of examination, returns and other documents maintained by the GST Registered person under the GST ACT. All these records are used to verify the correctness of turnover declared, taxes paid, refund claimed and the input tax credit availed.

According to GST law, Audit has a definition in section 2(13) of the CGST Act, 2017. GST Audit is conducted to assess the compliance of the Taxpayer with the provision of the GST Act and rules.

Whenever a taxpayer has the register under GST, all the records maintained by him would pass through GST audit. Here, the main importance is that to check the facts of the declaration of information in records and know compliance with the GST rules.

Types of GST Audits

There are three types of GST audits as per GST Law in India. Audit by Chartered Accountant, Normal Audit and Special Audit. Let us see them one by one.

- Audit by Chartered Accountant / Cost Accountant

The first GST audit is by a Chartered Accountant (CA) or a Cost Accountant. According to CGST rules every GST registered person whose aggregate turnover during the financial year exceeds Rs. 2 Crore shall get his accounts audited by a chartered accountant or a cost accountant.

Further, he shall file Audited annual accounts and reconciliation statement in Form GSTR 9C on GST portal online duly certified by Chartered Account or Cost accountant. GSTR 9C is all called as GST Audit Report.

- Normal Audit by GST officials

The GST commissioner or any officer with proper authority can undertake normal GST audit of any registered person for a specific period. However, the frequency and the manner of a GST audit will be decided by the commissioner or the proper officer in charge.

- Special Audit

The third type of audit under Goods and service Tax in India is the special audit. under special audit process the GST registered person can be instructed to bring his books of records including accounts.

Thus accounts examined and audited by the chartered accountant or a cost accountant can be demanded. Such directions can be given during any state of scrutiny, inquiry, investigation or any type of proceedings. The entire audit process depends upon the complexity of the case undertaken.

Important Rules of GST Audit:

As per the GST audit checklist, stricter rules are now in force that makes it absolutely necessary to make analysis of the data gaps between GST returns. It has strictly asked the business houses to conduct periodic checks and install internal controls. This would for sure do away with the data gaps and make sure the necessary compliance with the GST rules.

Mandatory Internal Audits:

GST authorities have now begun issuing show-cause notices to business houses for strict compliance of GST norms. Internal audit of the GST records could bring succor to a business in order to run check on the operating efficacy of internal financial controls and know important areas of risk and finally adopt necessary measures to minimize risks.

GST Audit Checklist:

The following are the mandatory GST Audit checklist that requires strict compliance:

- Checking of GSTR 3B in relation to GSTR 1 & GSTR 2A:

Two important points get covered under this heading:

- A) Interest and penalties in GST Act:

Under this recipient could claim extra input tax credit. And for this, it is compulsory for him to make a payment of interest @ 24%. This is applicable on the excess tax amount. Auditors need to reconcile the GSTR 3B with GSTR 2A to make sure that the organization would not claim extra tax credit. If it has been paid in excess, company would pay interest and the tax amount on the applicable date. When the GST authorities come to know about the data gaps between GSTR 3B and GSTR 2A, the tax payers might have to pay the interest and penalty.

- B) Amendment in GSTR:

When the auditor comes to know about the data gaps, he would recommend the management to make amendment of the invoices at summary levels in GSTR 1.

- Checking particulars of invoice:

It is very clear that there are specific rules related to the details in the invoices. If the format of the invoice varies, he would advise the management to make amendment of the invoice and include the requirements of the GST rules.

- Reversal of input tax credit for non-payment in 180 days:

At this stage the GST auditor has to check the following details:

- a) Difference between invoice date and date of payment. And this would not exceed 180 days.

- b) The amount of payment needs to remain equal with invoice amount and GST. If the payment amount is less than invoice amount plus GST, the input tax credit to the extent of short payment would get reversed.

- Reviewing e-way bill and matching with invoices:

This step consists of three stages, such as:

- a) Results of any mismatch shown in the e-way bill in relation to invoice. As it is a familiar fact that an e-way bill is not alterable and it is not possible to delete it. But it is permissible for cancellation within 24 hours of its generation. When the goods get shifted without e way bill, the designated authority could impose fine for this.

- b) Important points:

- Whenever it is necessary for business, e-way bill is quite unavoidable.

- And details given in the e-way bill need to match with invoice.

- c) Movement of goods in non-motorized vehicles:

Whenever transportation takes place in non-motorized vehicles, the necessity of issuing e-way bill does not arise. As some businesses are taking to this practice in order to avoid the e-way bills, internal auditors need to closely scrutinize the e-way bill is more worth more than fifty thousand rupees.

- Cross-checking the stock pending with job-workers on 30th June, 2017:

As it is mandatory that goods lying with job workers on 30th June 2017 need to get received within a period of one year. The capital goods lying with job workers require to be brought back before 30th June, 2019 (within a period of two years).

Grow your Business to the Next Level with Barcode

Whenever we buy something through which connect with a barcode, but rare we notice them. But role of barcode is effective and efficient for our economy, from small businesses to large multinational companies, so it is very important to obtain barcode.

If you are looking to take your business efforts to the next level, then you must invest in a proper barcode for your products and apply for Barcode Registration. Even if your business is completely digital, you gain another level of confidence and trust from potential customers and suppliers when you invest in a physical barcode get it now. Here team of Filing Bazaar helps you in barcode registration and all your business related legal services.

A barcode is “A readable machine that reads code in the form of numbers or a pattern of equal lines which varying widths and identifying a product”. Barcode systems help businesses to track products and stock levels through software system allowing for incredible increases in productivity.

Here we see a few reasons that you need a barcode for your business in India.

Barcode will allow you to grow up with sales of your products to report to retail outlets.

Many businesses start with the online, but the distribution that a large retail chain can give is second to none. In order for a retail chain to consider your business, they must have accurate sales reports of your past sales. A barcode is one of the only ways to do this in a legal manner which will accept. Investing in a barcode today will improve your numbers when you go into a retail store in order to show off your past sales records.

Follow your sales and upgrade your marketing efforts

A barcode will help you with your marketing analysis. Many people sell things online without knowing who is buying them why. With a physical barcode, you can track the demographics of people who are buying your products. This will help your marketing campaign to be more precise, saving money as you increase your overall conversion rate.

Barcode will help you with your tax records as well

If you are looking to stay out of trouble once you actually begin selling your product in large quantities, having a barcode will help you to separate all of your sales and expenses from expenses that do not matter to your business. You will receive less of a hassle from tax collection agencies if invest in a barcode today.

Although there are many other reasons to buy a barcode, the above three reasons are certainly enough to you get started off on the right foot when it comes to your business.

Through barcode you get accurate result

You know what makes you to run a small business really hard? It is simple fact because we are human. We all make mistakes. So, how can we overcome this?

Putting a barcode on an item makes it instantly readable to a computer paired with a scanner. It lets your computer do all the heavy lifting for you!

Now, computers aren’t perfect, but they don’t ever get tired. It also turns out that they are significantly more accurate than any human ever could be.

Not only will you be more accurate and efficient by using a Barcode System, but the customer also gets a better impression that your business is a professional organization.

Use your time more wisely and become more efficient

Nobody likes to wait for anything. For example if you had to line up behind the counter at Wall Mart, and the cashier manually keyed in each item a customer purchased. You would not be a happy customer having to wait for that long of a time. Bar coding allows you to process your inventories faster than any other manual method? It helps to free up a good amount of time.

View Source: https://filingbazaar1.blogspot.com/2019/05/grow-business-to-next-level-with-barcode.html

What Should You do for Private Limited Company Registration in Delhi?

Are you planning of getting a company registration in India, well you are at the right place. We offer you the fastest company registration by using India’s fastest network. You can register your company as proprietorship firm or private limited company in Delhi within minimum time at affordable price. Private Limited Company or proprietorship is the best corporate structure to start your own business. Start up of Proprietorship firm or private limited company in Delhi is the most familiar form of business. A Company registration will be done under the Companies Act, 2013 by Ministry Of Corporate Affairs. You get your company registered in 1-7 working days.

Here Filing Bazaar will assist you with our great team services of expert professional of charted accountant, lawyers, bankers to work according to your requirements in Simple, Professional and Easier manner which makes your work faster within the limited time and they guide you with the proprietorship or private limited company registration in Delhi.

Mandatory Requirements for Company Registration

Now days, company registration has been eased a lot by the Ministry of Corporate Affairs (MCA), further initiatives like startup India has also boosted the company registrations all over India. Further, company allows you to raise funding from the Angel investors, Venture Capital etc. However, to form a private limited company or proprietorship there is some mandatory requirements:

- Minimum two members are required to start a private limited company registration in Delhi.

- Maximum Two Hundred Members required but in proprietorship firm registration single is enough.

Documents Required For Proprietorship Firm Registration Or Private Limited Company Registration In Delhi:

- PAN Card

- Aadhar Card/Passport/Voter’s ID Card/Driving License

- Latest Bank Statement/Utility Bill

- Scan copy of Signature (Should Match on PAN Card)

Registered Address (Residential/Commercial place of our company)

- Any Utility Bill

- Rent Agreement with NOC from Owner/Landlord.

- If own property we required property details.

Procedures to Start Up Registration Of Proprietorship Firm Registration or Private Limited Company In Delhi

- Ist Working day -> SUBMISSION OF APPLICATION

- IInd Working day ->VERIFICATION OF DOCUMENTS

- IIIrd Working day -> SUBMISSION OF DOCUMENTS

- IVth Working day -> ACHIEVE THE REGISTRATION CERTIFICATE.

Filing bazaar is the largest legal service provider which is located in Delhi with broad wide services of private limited company registration in Delhi or proprietorship registration with expert professionals.

For more details regarding the Private Limited Company Registration in Delhi or proprietorship firm registration or any other services related to your business please feel free to contact our experts.

View Source: https://filingbazaar1.wordpress.com/2019/02/21/private-limited-company-registration-in-delhi/

What is the Process of Trademark Registration in Gurgaon?

If you are looking for Trademark Registration in Gurgaon or Applying for Trademark or looking for Brand Name/Trademark/Logo Registration, Trademark Lawyer, Trademark Registration India or Delhi, Filing bazaar teams are there to provide Trademark Online, Renewal of Trademarks or Trademark Infringement, and then you get your legal solution for your business. Basically, a trademark is a “brand” or “logo” that you can use to distinguish your product from those of your competitors. Through trademark registration or you can say logo registration/brand registration; you can protect your brand or logo by restricting other people from using the same.

Get your Logo/Trademark Registered by the expert and largest attorney/registered agency of filing bazaar for TM at the best prices and in minimum time at India. We are specialized in TM/LOGO registration with pan India presence. We are a global player & have many reputed clients in all over the world. Our team is best in follow-up and is committed to serve you in a best way and in legally professional manner. We provide Trademark Registration services all over India like Gurgaon

- Pan Card

- Address Proof: Aadhar Card, Voter Id, Driving License, Passport – 3.Any One Of The Proof.

- Stamp Paper for Creation of Power Of Attorney (Contents Will Be Given By Indiafilings.Com Which Needs To Printed In Stamp Paper and Signature Of Applicant Is Required In Scan Copy)

Logo (if Applicable)

Certificate of Incorporation, If Applicable

Msme Certificates If Applicable

Trademark Registration Process

Step 1: To initiate the process, you have to make the payment and once Payment is done you will get the Client Portal.

Step 2: Have to fill Trademark details in Client Portal along with Logo and Proof (ID/Address)

Step 3: Once Portal is filled we will send you Form-48 for your Trademark Registration

Step 4: You should take Print of this Form-48 in Rs.100 stamp paper and have to sign on both the pages and you have to upload this stamp paper in Portal again or you can send attachment by mail

Step 5 : Once we receive Form-48 will Generate and give you Temporary Number, You have to check the details of your brand name and you must confirm us by mail for applying Permanent Number

Step 6: Once we receive a confirmation mail from your side for Processing Permanent number will apply same to IP India.

Step 7: Within 2 working days you will receive your application number so that you can launch your brand name with TM Symbol

View Source: https://filingbazaar1.blogspot.com/2019/02/process-of-trademark-registration-gurgaon.html